Fake Social Security Cards for Dummies

Fake Social Security Cards for Dummies

Blog Article

“Our Place of work conducts ongoing analytics of on the web transactions and we hunt for anomalous conduct, and if we see new attributes, we flag These and put into practice additional controls to halt any habits that may be potentially fraudulent,” claimed Joe Lopez, assistant deputy commissioner for analytics, review and oversight at Social Security.

Social Security staff members do Get hold of the general public by phone for organization uses. Ordinarily, the agency phone calls people who have not long ago used for your Social Security profit, are presently acquiring payments and call for an update for their history, or have requested a cellular phone get in touch with through the agency.

You are not permitted to use intervals, commas, or other special figures for many answers, including addresses. If you get a message concerning this, return and enter the knowledge with out durations or other people.

"I am outraged that someone would focus on an unsuspecting public in this way," claimed Commissioner Jo Anne B. Barnhart. "I've asked the Inspector Standard to use all the sources at his command to locate and prosecute whoever is perpetrating this fraud."[207]

are lawfully admitted to The us devoid of do the job authorization from DHS, but have a sound non-get the job done reason behind needing a Social Security selection; or

Based upon your problem, you might be able to apply for a alternative card online. Reply a number of questions on yourself, and we will demonstrate The easiest method to make your request.

You are able to use as much as 4 months prior to deciding to want your retirement Added benefits to get started on. Such as, if you turn sixty two on December two, you can start your benefits as early as December. If you want your benefits to get started on in December, you'll be able to implement in August.

Social Security offices are now open only for in-particular person appointments for limited, vital cases, based upon community office ailments. Having said that, it is possible to continue to apply for a replacement Social Security card online and by mail.

Incorrect social media tackle. To see get more info the listing of Social Security’s official social media channels, we really encourage you to go to

Regardless of its regressive tax level, Social Security Gains are calculated employing a progressive profit system that replaces a much increased share of very low-earnings staff' pre-retirement money than that of increased-money staff (Though these low-revenue personnel pay back a higher percentage in their pre-retirement profits).[157] Supporters of the current system also point to a lot of research that show that, relative to large-revenue workers, Social Security incapacity and survivor Gains paid on behalf of lower-revenue personnel greater than offset any retirement Advantages That website could be missing thanks to shorter daily life expectancy (this offset would utilize only in a population amount).

Moreover when investigating fraud in other SSA systems, the Social Security Administration may well ask for investigatory aid from other legislation enforcement organizations including the Place of work from the Inspector Basic along with condition and native authorities.[209]

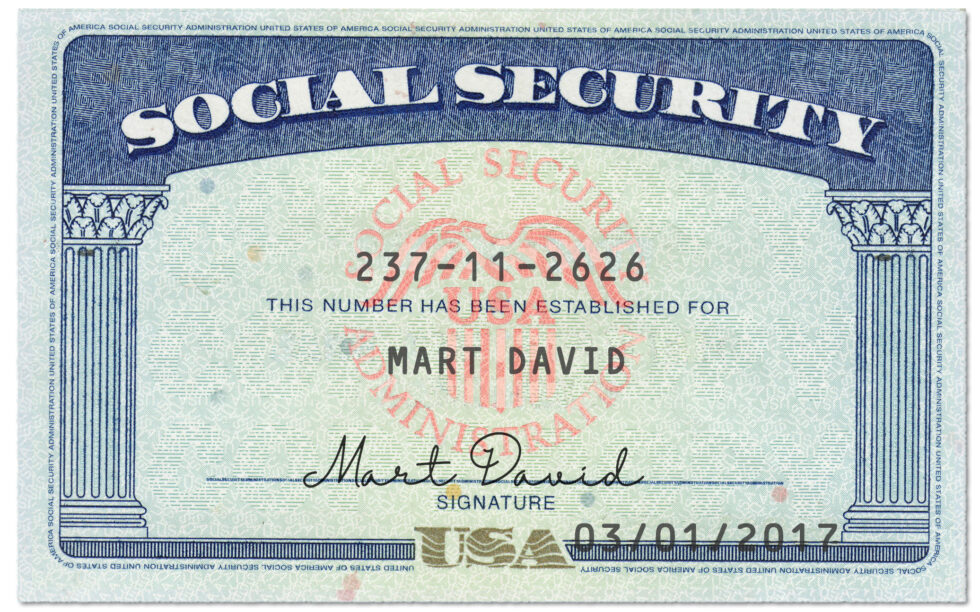

It is against the law to reproduce federal personnel qualifications and federal regulation enforcement badges. Federal legislation enforcement won't ever mail pictures of credentials or badges to demand from customers almost any payment, and neither will federal govt personnel.

The retirement impact happens each time a taxpayer saves much more on a yearly basis in order to lessen the complete variety of yrs he must do the job to build up enough price savings before retirement. The bequest influence occurs every time a taxpayer recognizes a lower in assets stemming from the Social Security tax and compensates by raising particular savings to protect long run expected expenses of getting children.[213]

Originally the benefits gained by retirees weren't taxed as income. Starting in tax 12 months 1984, Using the Reagan-period reforms to repair the process's projected insolvency, retirees with incomes over $twenty five,000 (in the case of married people submitting independently who didn't Are living With all the husband or wife Anytime throughout the year, and for individuals filing as "single"), or with combined incomes more than $32,000 (if married submitting jointly) or, in particular cases, any earnings total (if married submitting individually through the husband or wife inside a calendar year during which the taxpayer lived While using the wife or husband Anytime) typically saw Component of the retiree benefits topic to federal profits tax.